Internet Gross Sales: What They’re And The Means To Calculate Them

Your gross profit margin, which is the proportion of your gross revenue to your gross revenue, indicates how efficiently you generate revenue out of your direct prices. As you presumably can see, the distinction between value of sales and operating bills depends on the nature and the type of the enterprise. Nevertheless, the overall precept is that value of gross sales displays the direct costs of generating income, while working expenses replicate the indirect prices of supporting the business operations.

Value Of Gross Sales And Working Expenses

- Depending on the business’s measurement, type of enterprise license, and inventory valuation, the IRS might require a specific inventory costing technique.

- Combining these numbers determine the total value of services for your service enterprise.

- Value of Items Offered is also referred to as “cost of sales” or its acronym “COGS.” COGS refers back to the direct prices of goods manufactured or purchased by a enterprise and sold to customers or different companies.

- At the top of the current 12 months, the corporate is left with $10,000 price of unsold t-shirts.

- The starting stock is the worth of the raw supplies, work-in-progress, and finished items initially of the accounting interval.

- A business can enhance its manufacturing efficiency by implementing course of improvements, high quality control, automation, or innovation.

Corporations adjust for write-offs or write-downs on stock because of losses or damages. These write-offs occur before a sale is made rather than after. Allowances are less widespread than returns however may arise if an organization negotiates to decrease an already-booked income. The company additionally realized a internet achieve of $2,000 from the sale of an old van and incurred a lack of $800 for settling a dispute raised by a consumer. However, you’ll have to have sufficient justification to do so or your customers may take their enterprise elsewhere. Internet Revenue is also used for evaluating performance through the years and serves to show the expansion development for a company https://www.kelleysbookkeeping.com/.

Why Is Net Income Important On Your Small Business?

If the corporate makes use of accrual accounting, gross sales are booked when a transaction takes place. If it makes use of money accounting, they are booked when money is obtained. Working revenue is realized by way of a business’s primary exercise, such as selling its products. Non-operating revenue comes from ancillary sources corresponding to curiosity revenue from capital held in a financial institution or income from renting a business property. Web income is then used to calculate earnings per share (EPS) utilizing the common shares excellent, which are additionally listed on the earnings statement. EPS is calculated by dividing the web income determine by the variety of weighted common shares excellent.

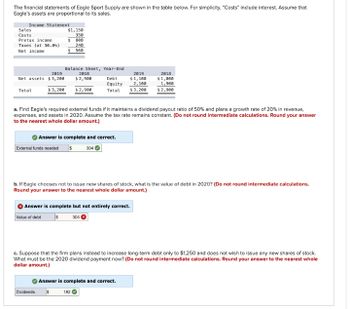

You ought to think about our supplies to be an introduction to chose accounting and bookkeeping topics (with complexities likely omitted). We focus on monetary statement reporting and do not focus on cost of sales on income statement how that differs from earnings tax reporting. Therefore, you want to all the time consult with accounting and tax professionals for help together with your specific circumstances. From ABC’s 2023 info we see that the company’s gross revenue was 20% of gross sales, and therefore its value of goods sold was 80% of gross sales. If these percentages are reasonable for the present yr, we are able to use them to estimate the value of the stock on hand as of June 30, 2024.

Tips On How To Calculate Cost Of Gross Sales Out Of Your Accounting Records?

The price of gross sales can have a major influence on the profitability, money move, and competitiveness of a business. Due To This Fact, it’s important to know how to calculate and report the cost of gross sales accurately and persistently. In this part, we are going to clarify the basic formula for calculating the cost of gross sales, and supply some examples of how to apply it in several situations. Cost of sales is the total sum of money spent to produce and deliver the products or companies that you just promote.

Price Of Products Offered And Taxes

Therefore, it is essential to select the best term for your business and to calculate it accurately and persistently. Price of gross sales is a broader term that includes all the prices incurred within the means of producing revenue, corresponding to direct labor, direct supplies, commissions, transport, and overhead. Value of gross sales is extra generally used by service-based companies, corresponding to consulting, software, or media, that don’t have a bodily inventory of products. Cost of sales may also range relying on the amount and complexity of the providers provided.

The first/oldest costs will stay in stock and will be reported as the value of the ending inventory on the steadiness sheet. Underneath the FIFO value circulate assumption, the first (oldest) prices are the primary prices to go away inventory and be reported as the price of goods sold on the income assertion. The last (or recent) costs will stay in inventory and be reported as inventory on the stability sheet.

Leave a Reply