How To Estimate Uncollectible Accounts Under Gaap

The choice to write off a debt impacts an organization’s financial statements and tax filings, and due to this fact must be handled with utmost diligence to make sure compliance with the regulation and honest monetary reporting. At CoCountant, we specialize in precise bookkeeping and accounting companies, including the administration of allowances for uncollectible accounts. By analyzing buyer payment behaviors, historic tendencies, and different relevant knowledge, we help companies reduce dangerous debt dangers and accurately forecast cash move. The journal entry ensures that the bad debt expense is recognized on the revenue statement, reducing the online income by $35,000. At the identical time, the allowance for doubtful accounts is increased on the stability sheet, reducing the net accounts receivable by the same amount, thereby presenting a extra correct financial position. The share of credit score gross sales methodology is an earnings assertion approach and estimates the required unhealthy debt expense for an accounting interval utilizing a percentage of the credit score sales made throughout the same period.

By adhering to those best practices, firms https://www.personal-accounting.org/ can successfully handle their accounts receivable, scale back the chance of uncollectible accounts, and keep healthier cash flows and more accurate monetary reporting. The initial estimation of uncollectible accounts beneath the allowance technique entails recording the estimated unhealthy debt expense primarily based on either the Percentage of Gross Sales Technique or the Growing Older of Accounts Receivable Method. This estimation creates an allowance for doubtful accounts, which is a contra-asset account that offsets accounts receivable. Based Mostly on this calculation the allowance technique estimates that, of the credit sales of sixty five,000, an amount of 1,625 will turn into uncollectible at some point sooner or later. Utilizing the allowance technique, complying with the matching precept, the quantity is recorded within the present accounting period with the following proportion of credit score gross sales methodology journal.

Streamline Your Accounting And Save Time

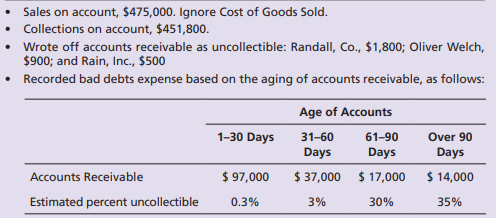

To account for this chance, businesses create an allowance for uncertain accounts, which serves as a reserve to cowl potential losses. Common monitoring and adjustment of the allowance for dangerous debt are essential to ensure its accuracy. As new data becomes out there, companies should evaluation and replace their estimates accordingly. For example, if a customer’s monetary situation deteriorates, the allowance might need to be increased to mirror the upper chance of non-payment. The proportion of gross sales technique entails estimating the percentage of credit score sales that received’t be collected based on historical information. The Aging of Accounts Receivable Technique categorizes accounts receivable based on the length of time they’ve been outstanding and applies completely different percentages of uncollectibility to each category.

These legislative modifications represent some of the most comprehensive tax updates in current years, affecting each individual and corporate taxpayers. The three instance companies, Dell, Apple and Cisco—all manufacturers within the high-tech industry—exhibit very completely different patterns when estimating collectibility and establishing allowances. Preserving open strains of communication can help in figuring out any potential points early on and dealing collaboratively towards a resolution earlier than the account turns into a legal responsibility. In the quest for self-empowerment, mastering the art of time administration emerges as a crucial…

Firms typically use methods like growing older of accounts receivable or a share of gross sales to determine the allowance quantity. Management rigorously examines an accounts receivable growing older schedule to estimate what amount of every account shall be uncollectible. Then a journal entry is made to report the uncollectible balance by debiting dangerous debt expense and crediting the allowance for unhealthy debt account. Managing uncollectible accounts is a crucial aspect of economic management for any business. It includes dealing with prospects who are unable or unwilling to pay their debts, which may have a major influence on an organization’s bottom line. In this part, we’ll discover some effective strategies that can help companies navigate the challenges of uncollectible accounts and make sure the easy functioning of their financial operations.

This entry reduces each accounts receivable and the allowance for uncollectible accounts by $6,000. The complete accounts receivable balance remains unchanged, but the web realizable value remains precisely said, because the allowance account has already anticipated such losses. The allowance for uncollectible accounts is an estimated amount of receivables a business allowance for uncollectible accounts doesn’t expect to gather. This estimation is recorded as a contra asset to reduce the total value of accounts receivable, reflecting anticipated uncollectible debts based mostly on historical developments, customer fee history, and industry requirements. The Share of Gross Sales Methodology is a practical and environment friendly method to estimate uncollectible accounts, particularly for companies with constant sales patterns and predictable bad debt rates. In the realm of finance, the flexibility to anticipate future uncollectibles is paramount for maintaining the integrity of an organization’s accounts receivable.

This anticipation permits companies to strategize their Allowance for Uncertain Accounts, which is a crucial element of monetary health. By analyzing historic information, firms can establish patterns and developments that indicate the chance of account delinquency. This evaluation is not just about looking at past numbers; it includes a complete understanding of buyer behavior, financial shifts, and industry-specific components that would affect payment outcomes. By analyzing its growing older reports, the corporate identifies a number of accounts that have exceeded their credit score phrases by a significant margin.

For the previous fifty two years, Harold Averkamp (CPA, MBA) has worked as an accounting supervisor, manager, consultant, college teacher, and innovator in instructing accounting online. For detailed expectations and tips associated to write down offs, see Writing Off Uncollectable Receivables. My Accounting Course is a world-class educational useful resource developed by specialists to simplify accounting, finance, & investment analysis subjects, so college students and professionals can study and propel their careers.

- This methodology provides a more detailed and accurate estimate of uncollectible accounts by contemplating the elevated risk of older receivables becoming uncollectible.

- As a contra asset account, debit and credit guidelines are utilized which might be the alternative of the normal asset guidelines.

- In the hunt for self-empowerment, mastering the art of time administration emerges as a critical…

- This technique does not involve creating an allowance for uncertain accounts, and bills are acknowledged immediately in opposition to earnings.

- Let’s say that ABC Firm sells $100,000 of products on credit through the month of January.

- The Pareto analysis method depends on the Pareto precept, which states that 20% of the customers trigger 80% of the payment problems.

Right-size Your High Quality Administration Documentation For Sqms No 1

With diligence, transparency, and adaptableness, companies can navigate this difficult terrain and make knowledgeable choices that profit their long-term monetary well being. For instance, a manufacturing company that uses accounting software can generate reports that present the getting older of accounts receivable. By reviewing these reports often, the company can determine any accounts which are overdue and take acceptable measures to gather the outstanding payments. Based on this review, ABC increases the allowance for uncertain accounts by $500 by debiting the allowance for doubtful accounts account and crediting the dangerous debt expense account.

Credit managers, however, emphasize the significance of stringent credit policies. By fastidiously assessing the creditworthiness of potential clients and setting clear credit limits, companies can considerably scale back their publicity to dangerous debt. Credit Score insurance policies are a multifaceted software that requires input from varied departments within an organization.

It is important to estimate the allowance precisely to guarantee that the financial statements replicate the true financial position of the company. To create the allowance, the company debits the allowance for doubtful accounts account and credit the unhealthy debt expense account. How you account in your unhealthy money owed will depend upon whether you employ the cash foundation or the accrual basis of accounting.

Leave a Reply